Find the Assessment That Fits Your Needs

Get started now and have your assessment delivered within 24 hours.

Investor (National) Assessment

Know the Country You're Investing In

Our Investor report brings you up to speed on risks and drivers of the local market.

Aimed at investors who are looking at broad indicators across the country, the Investor (National) Assessment delivers intelligence on broad risks and opportunities.

Who is this for?

- Investors evaluating entry into a new country who need a clear understanding of the political, regulatory, economic, and security environment before committing capital.

- Investors comparing multiple candidate countries and needing a standardized, side-by-side view of stability, governance quality, market pressures, and emerging risks.

- Funds performing early due diligence and wanting to understand whether macro-level risks could materially affect valuations, supply chains, or business continuity.

- Investors already exposed to the country who want a reliable, external read on recent developments, stress buildup, and the near-term risk trajectory.

- Risk officers monitoring portfolio countries for sudden shifts in political sentiment, regulatory posture, labor issues, or security trends that could affect existing assets.

Working on your own report? Let us help.

If you are working on your own work product, we can get you 80-90% of the way there, while informing the remaining portions. Integrate our results into your own report with or without attribution. We can deliver assessment results via a docx file for easy extraction and adoption.

It's easier, faster, and cheaper than doing it yourself!

Assessment Sections

The following report sections are included in each Investor Assessment (National) report.

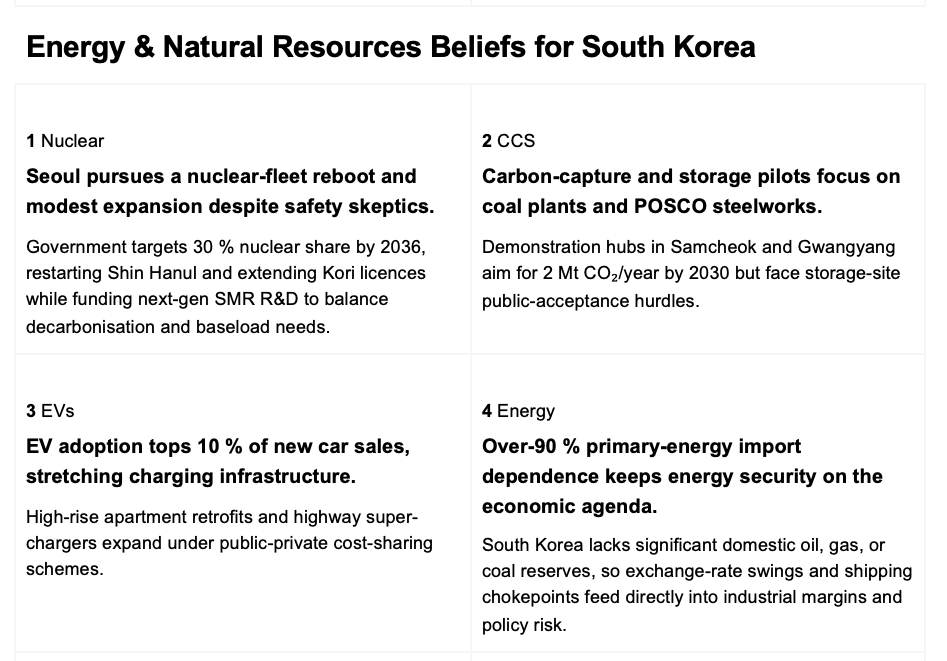

Beliefs

Beliefs are key drivers of the local economy and business environment across 20 different domains. These are intangible bits of local wisdom that, taken as a whole, create real understanding of the local environment.

Domains analyzed include:

- Competitiveness

- Demographics & Human Capital

- Energy & Natural Resources

- Environment

- Financial System

- Firms

- Food & Water

- Geopolitics & Defense

- Governance & Law

- Health

- Households

- Information Dynamics

- Infrastructure & Urbanization

- Macroeconomics & Growth

- Non-Interstate Conflict & Security

- Politics

- Social Cohesion

- Societal Resilience

- Technology & Innovation

- Transportation & Logistics

~55-60 pages in length

How This Section is Made

Our Beliefs items are deep analyst insights, pre-stored in our own knowledge-base, and used to inform analysis of recent events and issues across twenty knowledge domains. By having a constant store of “tenets” we believe in, we avoid analytical drift in preparing our reports and assessments.

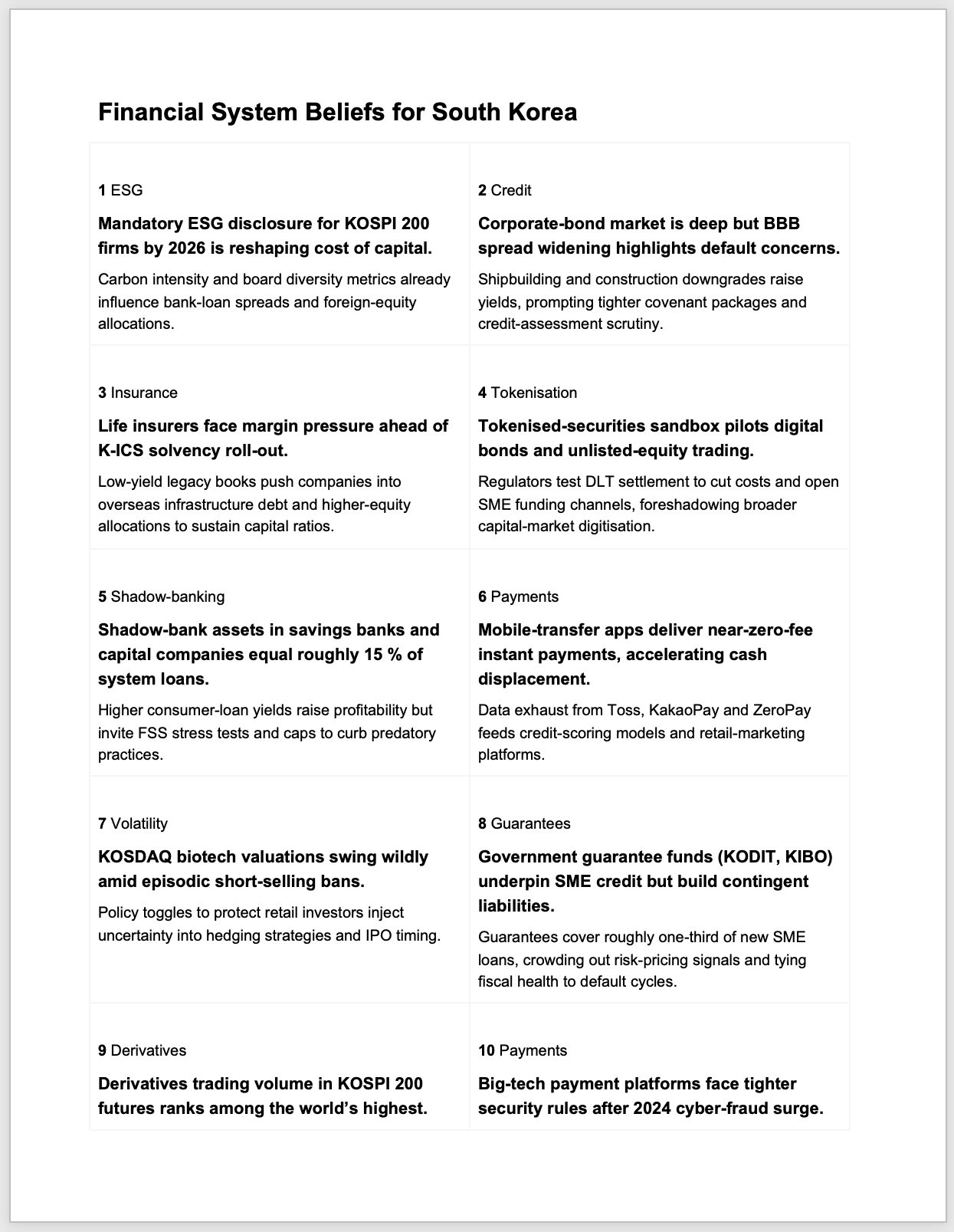

Risk Environment

Which risks show up the most in this market? Which risks are most impactful? We've gathered data--across 26 risk categories--on what people on the ground were talking about, writing about, and worried about over the last 12 months.

This section is comprised of three sub-sections:

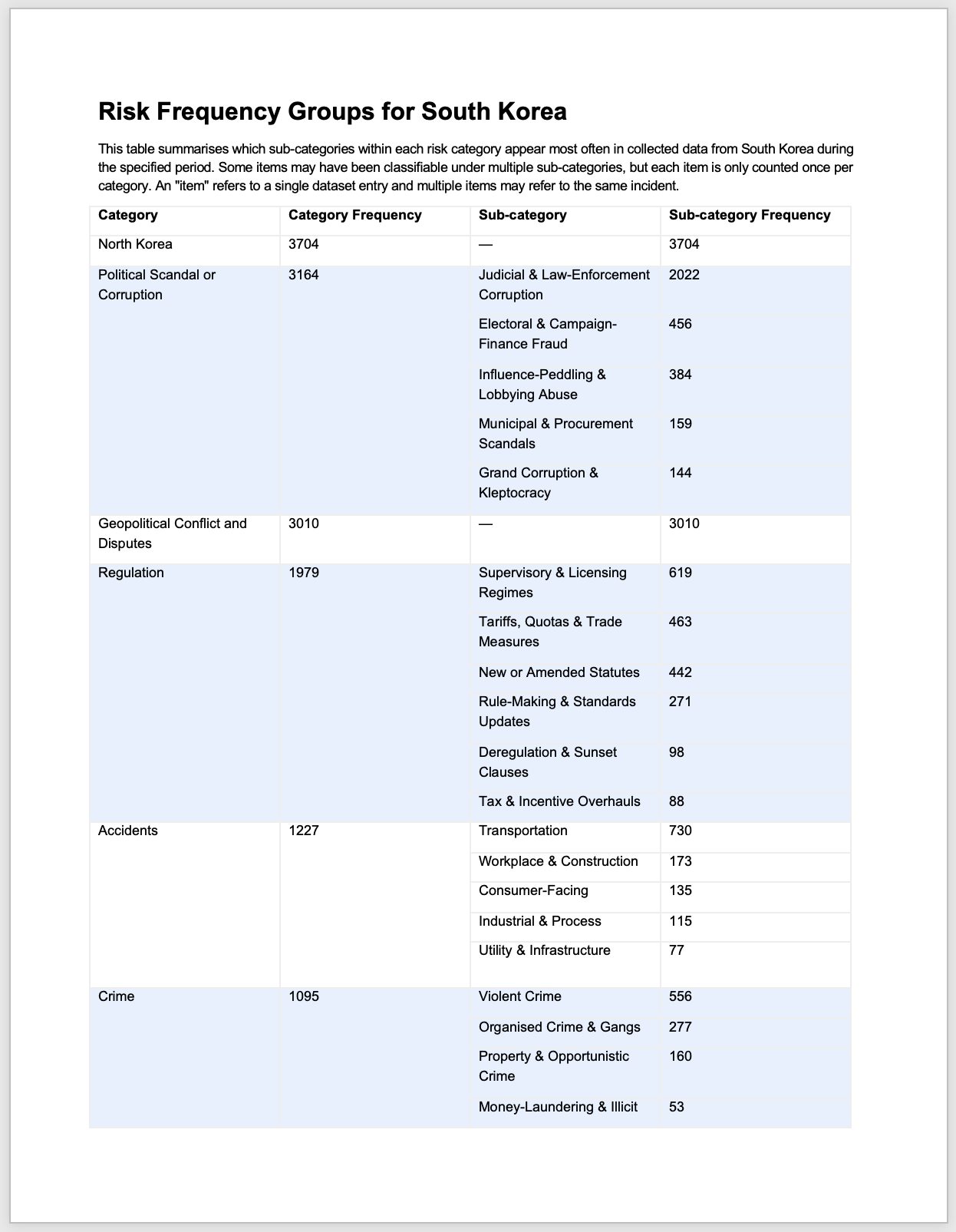

- Risk Frequency: Which risk categories were most talked about and most written about?

- Risk Subcategories: A detailed breakdown of risks by category and sub-category over the last 12 months.

- Risks Prioritized: Which risks are most impactful and most important to mitigate in this market?

~10 pages in length

How This Section is Made

The Risk Environment section is composed of three subsections: Risk Frequencies, Risk Subcategories, and Risk Rankings.

Risk Frequencies are made by counting up the number of categorizations we have made of data collected over the time period in question. When an assessment is ordered, we look back over the preceding 12 months at all of the risk categorizations we have made during that period. These categorizations don't capture everything that occurred during that time, but they reflect the frequencies of events and issues related to specific categories during that time.

Risk Subcategories

Each risk category is further broken down into smaller sub-categories for a better understanding of the types of events that have occurred and what kind of risk they presented.

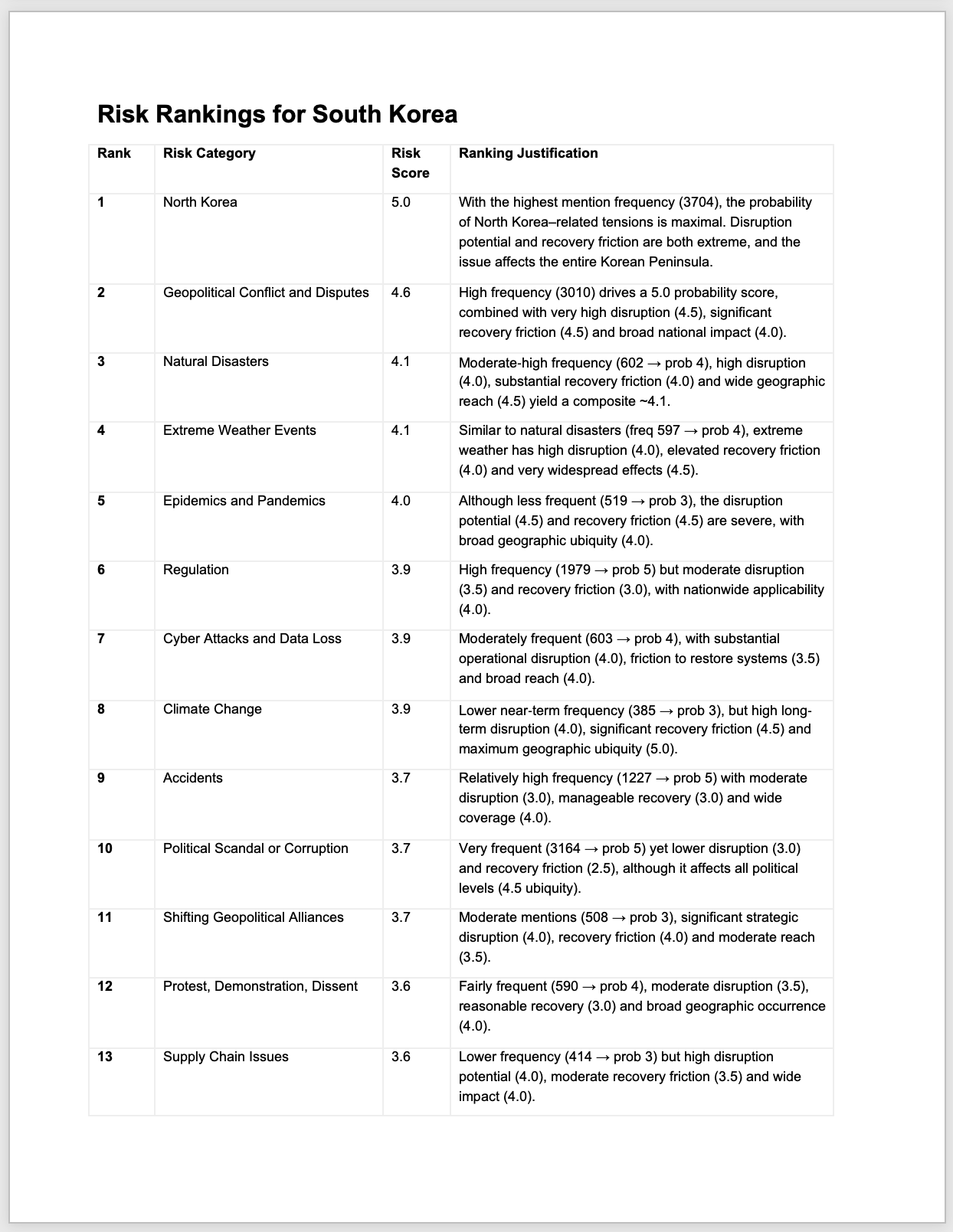

Risk Rankings

The risk categories we use are then ranked for a specific country, over the last 12 months. Scoring method: 1-5 for each of four weighted dimensions (40% disruption potential, 30% probability 2025-27, 20% recovery friction, 10% geographic ubiquity). Resulting composite = 0-5. All scores are directional and rounded to one decimal.

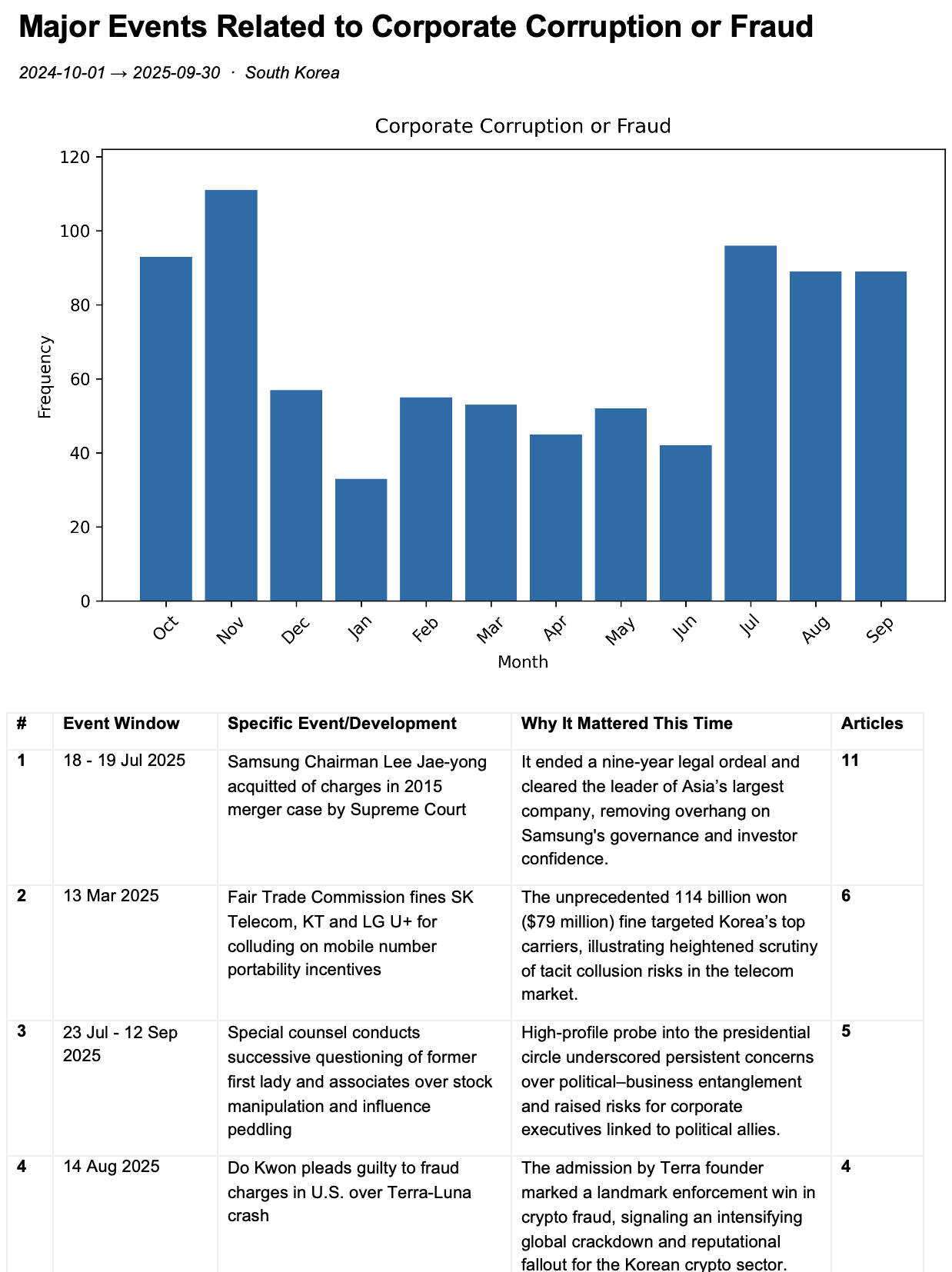

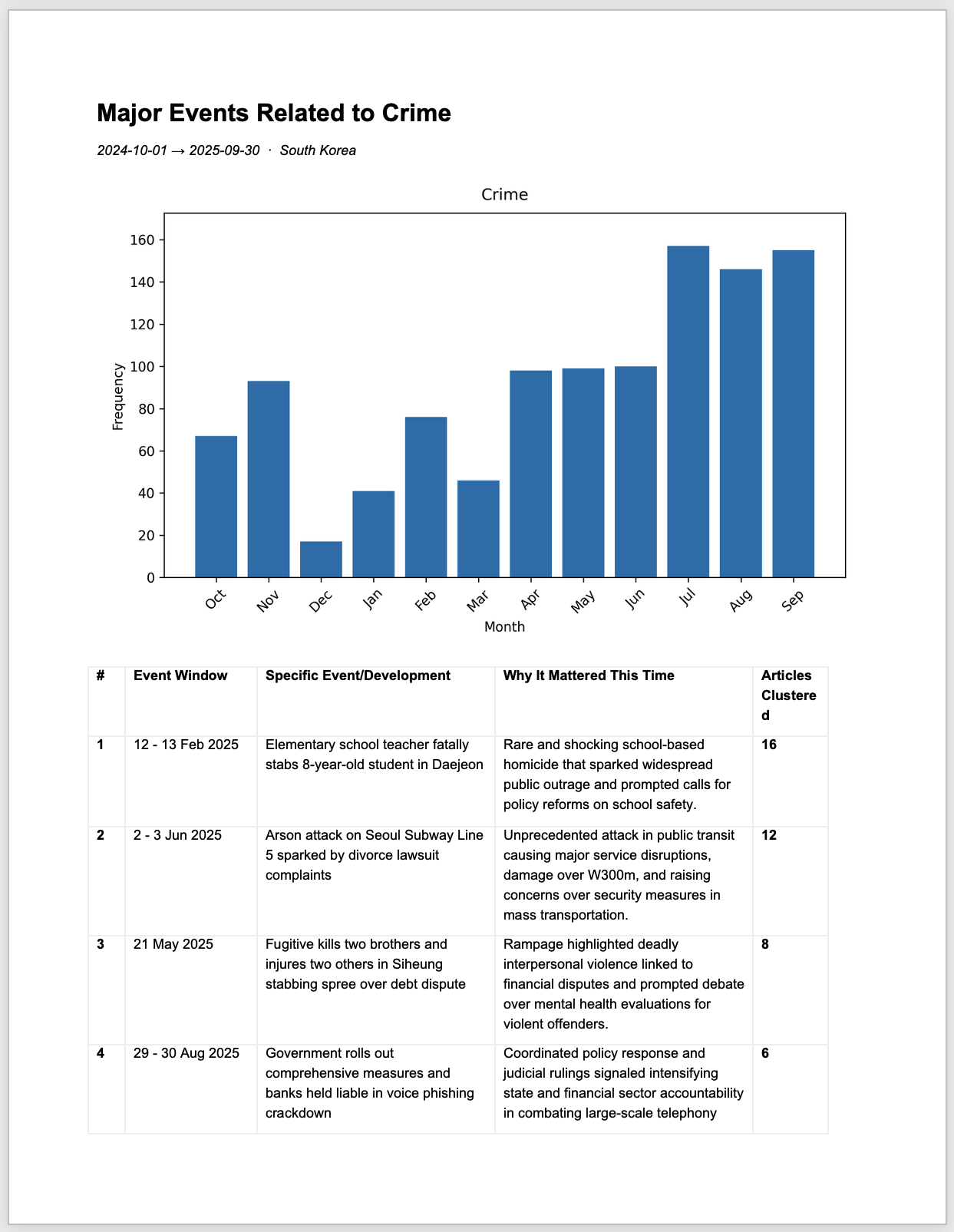

Risk Events

What risk events actually occurred over the last 12 months? We outline all the major ones across 26 risk categories.

- Accidents

- Climate Change

- Communal and Religious Strife

- Corporate Corruption or Fraud

- Crime

- Critical Infrastructure Failure

- Cyber Attacks and Data Loss

- Epidemics and Pandemics

- Extreme Weather Events

- Geopolitical Conflict and Disputes

- IP Protection

- Man-made Environmental Disasters

- Natural Disasters

- North Korea

- Political Scandal or Corruption

- Pollution

- Privacy

- Product Recalls

- Protest, Demonstration, Dissent

- Regulation

- Regulatory Enforcement Actions

- Shifting Geopolitical Alliances

- South China Sea

- Strikes and Work Stoppages

- Supply Chain Issues

- Terrorism

~40-50 pages in length

How This Section is Made

Risk Events

Prominent risk events are discerned and reported on for each category of risk we cover. The events are derived from previous “Developments” we have reported on for our intelligence reports over the last 12 months. Developments represent what people on the ground, in country, are talking about, writing about, and creating policy for.

Since our intelligence reports come out three times per week, we are often reporting on continuing stories and issues each week as they develop and morph. For our assessments, we then pull from these previously identified events to find the ones that represented the largest sources of risk over time rather than just the short snapshot given in acute reports.

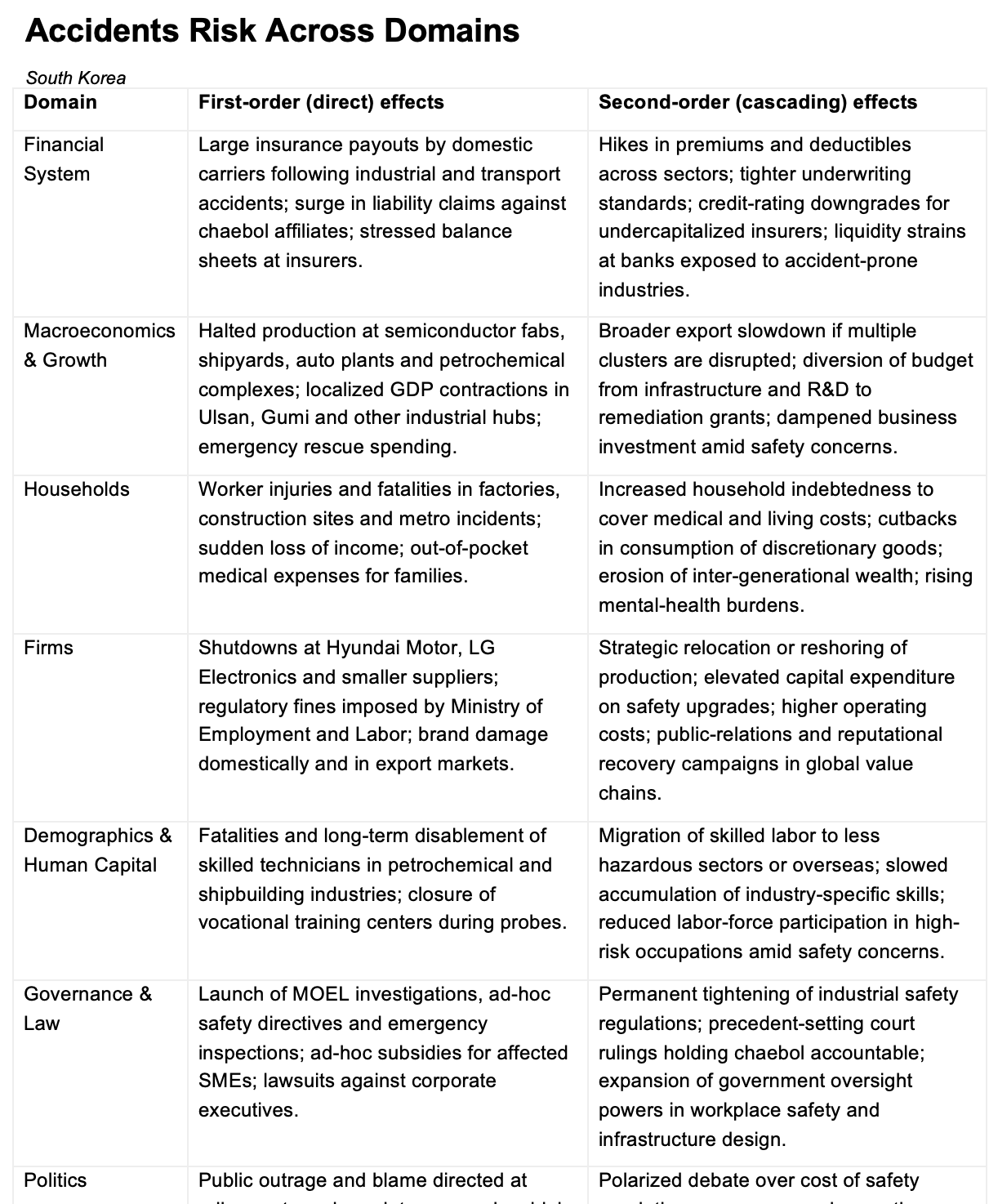

Risk Across Operating Domains

How does the risk environment in country impact the market in different ways? How does that risk cascade through the system?

We analyze the first and second order impacts of each of the 26 risk categories across 20 different operating domains. This will help you think about how the events you see around you may play out in your target country.

~8-9 pages in length

How This Section is Made

Risk Domain Analysis is where risk category issues and operating domains are analyzed together to see how risk in a specific country is actually effecting each domain. This analysis is done by AI cross-referencing our own risk data over the last 12 months, our Beliefs data, and our own country domain information.

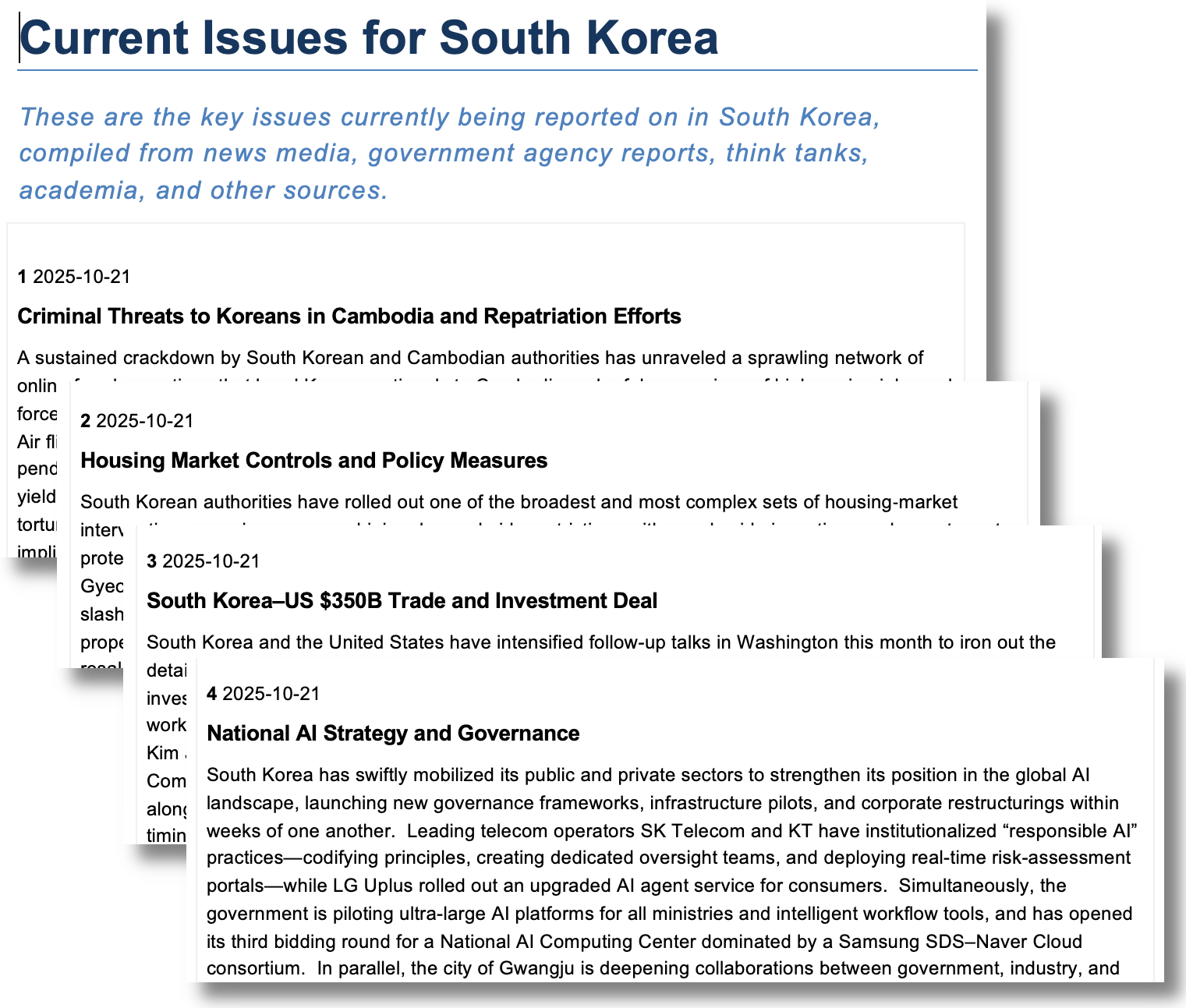

Current Issues

What's happening right now? What is everyone on the ground talking about, writing about, and concerned about right now?

Current Issues are derived from the "Developments" of the past two weeks--what was reported on in our country intelligence Daily Briefings over that period. We select only those developments spanning the whole of the last week (or longer) for inclusion.

~5-8 pages in length

How This Section is Made

Data is gathered from our intelligence data and from recent Developments reporting we have done. From among those Developments, we look for the most impactful ones that are currently still ongoing.

Have questions about our assessments?

How can we help?

Ready to order your Investor Assessment?

Get started now and have your assessment delivered within 24 hours.

See Investor (National) Assessment Pricing and OptionsAssessments FAQ

Each section of every report is generated independently using its own data pipelines and analytic methods. For a detailed explanation of how data is gathered, processed, and correlated for each assessment type, please refer to the individual product pages.

For site-focused reports, the analysis is tailored to the exact address or site you specify. For national-level reports, the primary variable is the date on which the assessment is produced, as all analysis reflects the most current one-year window of available data.

While each assessment follows a standardized production methodology for consistency, all underlying data is freshly collected and bounded to the previous 12 months to ensure relevance, trend visibility, and accuracy.

If you require an assessment for a location outside our current coverage, please contact us. We will review your request and advise whether we can produce it.

As a result, the information incorporated into our assessments is refreshed continuously and is as current as feasibly possible.

For online transactions, Erudite Intelligence does not collect or store any payment information; all payments are processed securely through PayPal. For invoiced corporate clients, only the billing details required for invoicing are collected.

We are also available for additional bespoke analysis or tasking upon request.

For site-focused assessments, we need the primary site address or exact site name.

For Executive Protection (EP) Advance reports covering multiple sites (up to five), we require the primary location plus any secondary addresses.

Because precise geolocation is critical to accurate analysis, we may contact you for clarification if any address information appears incomplete or ambiguous.

Each question is optional, but the more information you provide, the better we can tailor the assessment to your unique situation. Answer as many or as few questions as you are comfortable with.

Explore Our Assessments

Find the Assessment That Fits Your Needs